The 2021 version of the Rainforest Action Network/BankTrack report (which we fully endorse) is out today! We suggest you read it in full because it’s fascinating and includes interesting case studies on specific projects and climate disasters. But, if you don’t have time, we’ve summarized the findings about Canadian banks.

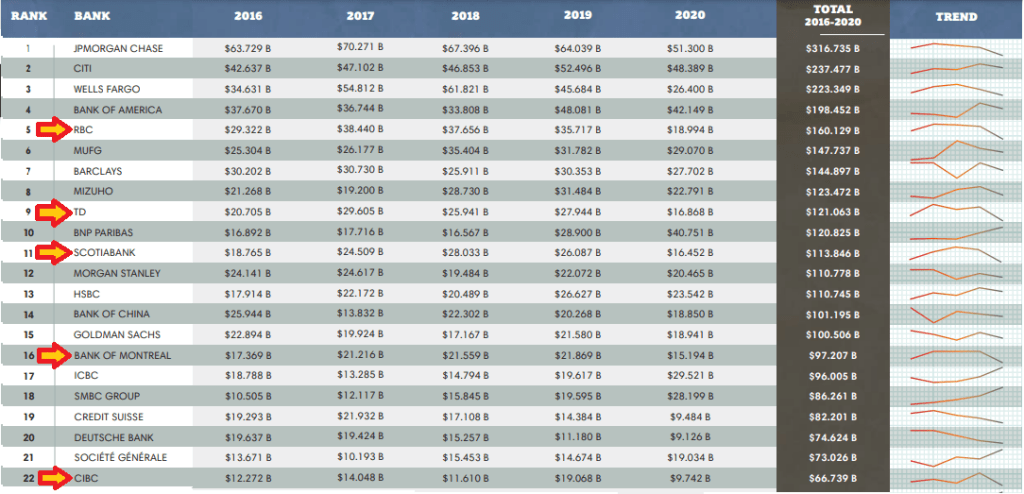

When you look at these numbers keep in mind that RBC has 1.62 trillion CAD in total assets whereas JP Morgan Chase has about 3.29 trillion CAD and CITI has 2.8T and Wells Fargo has 2.3T. As a percentage of assets, CAD banks are as bad or worse than the higher ranking banks.

In CAD, the total funding since 2016 (when most countries signed the Paris Accord) are as follows:

| RBC | $208B |

| TD | $157B |

| SCOTIA | $148B |

| BMO | $126B |

| CIBC | $86B |

Here you can see that BMO and CIBC, which didn’t make the dirty dozen are still among the top 25 global funders of fossil fuels. Compared to the 2020 report, things are mostly the same. TD, Scotiabank and CIBC have all fallen one spot, while BMO and RBC have help their ground.

You will also notice a substantial drop in fossil fuel financing in 2020 for all 5 Canadian banks. The question is: is this the beginning of a transition or a one-year pause caused by the pandemic?

Unfortunately, the policy analysis section of the report suggests that the banks will likely return to full-speed emissions acceleration in 2021. The policy scores look for concrete pledges and policies excluding certain types of projects and companies like thermal coil, tar sands, and arctic drilling and produce a score out of 200. The image below cuts out banks at the top and the bottom of the ranking (and a few in the middle) so you can see where they Canadian banks sit. As you can see, even awful American banks like Wells Fargo and JP Morgan Chase have policies that are as strong or stronger than all the Canadian banks.

RBC has moved up a lot here since last year because they created an actual exclusion for some of the worst coal companies in the world (unfortunately their exclusion allows them to still invest in lots of coal companies as long as they don’t do only coal). This is a welcome shift, but RBC still has a long way to go as they are the 12 largest coal financier in the entire world and the worst among Canadian banks.

In general, the Canadian banks are among the worst in the world, with only Chinese banks – who probably have their policy dictated by the Central Government – and one or two others below them.

Last but not least, the report has a completely new section examining Net-Zero Pledges.

This section has been added because suddenly everyone and their mother has a net-zero pledge, but there is a huge amount of variation among pledges. In general, we think the second column on the chart below is the most important — has the bank made intermediate commitments to cut financing in the short and medium term. It doesn’t really matter if banks stop financing new fossil fuel projects in 2050, because the whole industry has to be shuttered by then. Many of the projects the banks are financing today and in the next few years will still be operating in 2050.

There’s a lot going on here but in simple terms: green is good, orange is okay, red is bad and purple is atrocious. For Canadian Banks, there’s a lot of purple and no green. RAN and Banktrack are giving the banks who have pledged net zero by 2050 part marks for the pledge and part marks for their commitment to eventually disclose their financing, but a lot of big fat Fs in terms of their commitments to actually do anything substantive on a clear timeline.

BOTTOM LINE: The Big 5 banks are starting to feel the pressure on this issue and making vague announcements that are more about PR than actual impact. We have to let them know that we’re following closely and we can tell the difference between a real climate plan and a heavy layer of greenwashing. At Climate Pledge Collective, we’re urging Canadians to start a conversation with their financial advisor or branch manager and let them know that you’ve started looking around for a greener bank. The campaign is called BankSwitch and we’re asking all of you to learn more or sign up now.

2 thoughts on “Banking on Climate Chaos 2021”